While a borrower that have a complete-day work, a hefty put, NZ house, and you can good credit score, searching for a home loan is pretty simple. You will need to talk to a large financial company otherwise shop around to get the best rate of interest, but the majority finance companies would be ready to give to you personally.

Getting individuals that simply don’t satisfy fundamental financial requirements, delivering recognized for home financing is somewhat more difficult. For those who have a low deposit, you may be mind-employed otherwise a contractor, you may be new to the nation otherwise your borrowing isn’t higher, it can be a struggle to find a lender to invest in very first financial.

But it is maybe not hopeless. Whether or not your financial situation cannot match the loan mould, discover mortgage options. You might have to select a non-bank bank and build your loan in another way, nevertheless don’t have to give up to buy a house completely.

Exposure and prize practical lenders

Extremely finance companies features a set of fairly tight mortgage conditions. To apply, you desire documentation away from regular income over time, a hefty deposit always 20% proof of residence or citizenship, and you will an excellent credit see this here record. In market over loaded having create-be borrowers, it’s easy getting financial institutions to show down people who don’t see those people standards.

It is also from the risk. Individuals who don’t meet the criteria portray enhanced risk into lender. If you don’t have an effective deposit or a professional income, otherwise your credit score is bad, you might be expected to skip costs or standard into mortgage. You may have believe on your own ability to maintain your payments, however it is difficult to establish in place of papers and a confident borrowing background.

Are you currently a non-compliant borrower?

- Low deposit consumers ount they want, therefore it is tough to qualify for a simple mortgage.

- Individuals that have poor credit might have significant personal debt otherwise a history out of overdrafts otherwise unpaid credit debt making use of their lender, that’ll indicate it not be able to getting recognized to own home financing.

- New notice-employed, everyday experts and people who work on commission may find it hard to show their income over the years.

- Earlier consumers could have troubles to get their very first household as the important financial title are twenty-five or 3 decades, banking companies will get balk on lending to those closer to retirement.

- Brand new residents otherwise individuals to buy regarding overseas discover challenging to get a home loan too.

Certain low-old-fashioned individuals may match multiple of them kinds, therefore it is even more complicated to locate a mortgage.

Non-conforming borrower, non-compliant bank

If you find yourself a non-conforming borrower, it’s a good idea to search out low-conforming loan providers. Usually, in the event the lender claims no toward app, you might nevertheless get a home loan approved by way of a low-lender bank. Finance companies try minimal from the Put aside Bank legislation in addition to their individual business rules. This may cause them to become fairly inflexible they cannot bend the guidelines otherwise make exclusions getting borrowers just who don’t fit the new requirements. Non-financial loan providers bring financing but don’t always promote most other financial functions like discounts levels otherwise playing cards. Since low-lender lenders won’t need to adhere to Set-aside Lender statutes to loan-to-value percentages (LVR) they truly are a lot more flexible from the exactly who it provide so you’re able to. Of many borrowers find they could rating a mortgage because of an effective non-financial lender shortly after getting turned-down from the financial institutions.

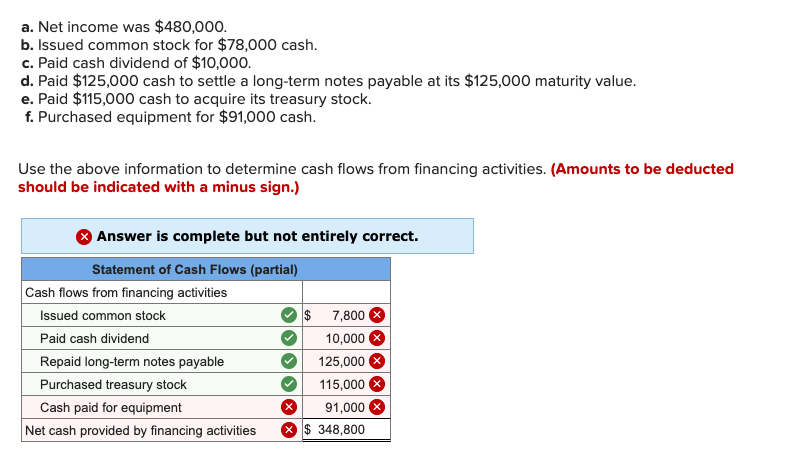

Charge, rates, or other differences

Whenever you are a low-compliant debtor and you also qualify for a home loan thanks to a low-financial financial, your loan will not be similar to a standard mortgage. Because low-compliant individuals depict increased risk into bank, finance are more pricey and less versatile. You may have to spend a-one-out-of commission when you take the actual loan, and your rate of interest is likely to be greater than the individuals offered by the major banking institutions. You do not have the ability to availability the loan provides considering with antique mortgage loans both rotating credit business or a mix of fixed and you may drifting rates.

Although not, this won’t need to last permanently. Really lenders allow you to button their mortgage off to a good conventional bank or structure after a few years, given you keep up that have payments and you can chip aside at the dominating. Instance, when you have in initial deposit of 5% to start with, you’ll fundamentally have the ability to switch over to help you a standard mortgage having all the way down costs after you have paid back another type of fifteen% and you may effectively enjoys a keen 80% LVR. If you had bad credit very first, and then make regular payments on your own mortgage normally shore enhance credit score and you will change your chances to have coming mortgages. Once you’ve had a mortgage for some time, you are in an improved updates in order to negotiate along with your bank or any other financial.

A mortgage broker might help

In case your lender converts you down and you’re incapable of satisfy mortgage requirements, cannot depression. Non-compliant mortgages is actually approved non-stop you simply need to discover which place to go. And the most practical way to discover the correct financial has been an expert broker. A mortgage broker should be able to talk to non-lender lenders on your behalf, negotiate the very best prices, which help you get in the earliest domestic for once.