When you find yourself searching for to find an establishing for a good price, a home auction is one of the top metropolises commit. But not, to acquire a home via an auction isn’t as simple as they 1st seems, thus why don’t we explain to you how property auction funds funds work.

What is a market loans loan?

Public auction finance is just a sub-group of bridging funds, whether or not the one that boasts more stress just like the properties claimed in the public auction always want to see the customer finish the purchase contained in this 28 days, with respect to the public auction home.

Many people to get within auction opt for these types of brief name fund service as compared to a purchase-to-Assist (BTL) home loan, because the with BTL mortgage loans there clearly was a chance you will not be approved, or even the currency can’t be set-up in the due date.

This will make connecting finance a perfect short-term fund service to possess effective bidders in the uk who don’t features immediate access to help you private financial support, or who are not cash customers.

Why does auction finance really works?

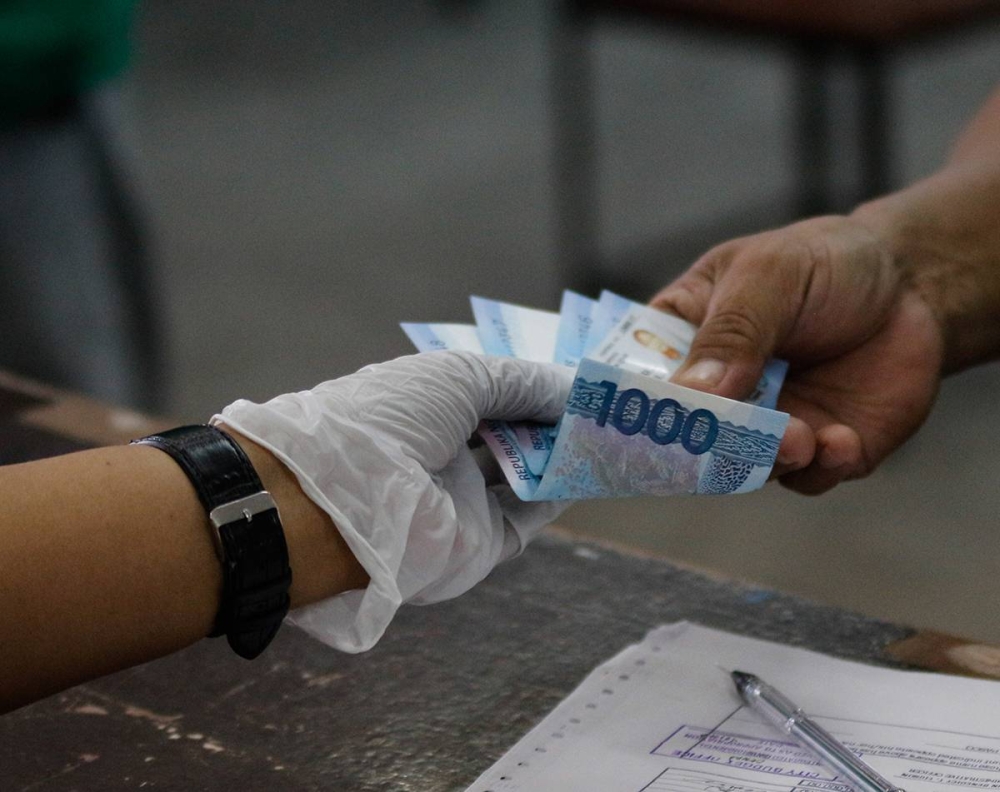

When you find yourself the profitable buyer if the gavel hits, you’ll want to spend at least 10% just like the in initial deposit towards the domestic, including auction particular charges, such as admin charges. Following this, you’ll have 28 months to invest the rest ninety% equilibrium.

Of a lot bridging finance organization often give around 70-80% of purchase price and that do exit the customer being required to put in after that fund. Bidders generally speaking purchase a property during the public auction that requires certain repairs or modernisation and frequently attribute the water cash toward such will cost you. This is why obtaining maximum count into purchase price try of one’s upmost benefits.

With Acceleration Bridging, we offer income-leading public auction financing financing as high as 90% with no need for additional coverage. With the help of our vibrant personal financing and you can swift procedure, we are able online payday loans Utah to ensure a 2-month recovery, providing you place so you can breathe!

Our easy and quick 90% market loans options is actually in person offered to users to invest in a property that is value over ?100,000 or over so you’re able to ?five-hundred,000 by way of auction.

It is essential to remember that if you are unable to finish the buy, you may want to get rid of the home along with your first ten% deposit and any other can cost you you have got sustained, particularly surveying and other charge.

Whenever applying for market loans, it is very important understand that having a proper-invented and you may obvious get off technique is secret weapon to success whenever applying getting finance.

An exit technique is how you intend on repaying the mortgage at the end of this new termmon hop out actions become remortgaging or attempting to sell the fresh new asset, which are confirmed which consists of saleability or an agreement in principle.

Interest levels may also be used on your current amount borrowed and ought to qualify when strategising the log off bundle. Rates towards the auction finance funds is going to be recharged for the 3 various methods:

- Hired attract mode the financial institution computes simply how much possible are obligated to pay on the beginning of the phrase and can range from the month-to-month focus money to your financing. This will mean you might be borrowing the interest having a set period of time and you will probably following pay that which you right back at the bottom.

- Month-to-month attract only setting you have to pay attract monthly and if you come to the termination of label, you will then spend the money for financial obligation entirely.

- Rolling upwards desire means focus try totalled and you may added to the loan. At the end of the mortgage label, might afford the complete desire and loan amount.

How exactly to make an application for an auction loan

Very, you’ve obtained the house or property you’ve been bidding to your, paid back new 10% deposit and then you will want to apply for the market mortgage.

- Sending in the application. Merely see our contact page and you can fill out the form with your details. Be sure to feel just like the accurate that you could when filling in the application form because will help the decision-providers.

- We’re going to procedure the offer. Once we’ve got gotten the job, we try to send a plunge or other records returning to your inside couple of hours.

- After obtained, then you certainly have the option to just accept otherwise deny the offer. After you take on our very own promote, only get back the fresh new documents therefore the countdown starts!

- Velocity Connecting up coming will get started on the judge at the rear of-the-moments files and we will train the solicitors to begin. We could possibly in addition to teach an official valuation whenever we believe it’s expected.

- We next do our very own regular credit and you may media inspections, do the research and our very own Lending Director often check the home.

- Ultimately, the fresh new judge and you will underwriting techniques started to a near additionally the deal finishes.

Its that facile! If you want more information on our auction money provider otherwise want to apply, see our very own contact form .