Building a strong Borrowing from the bank Profile

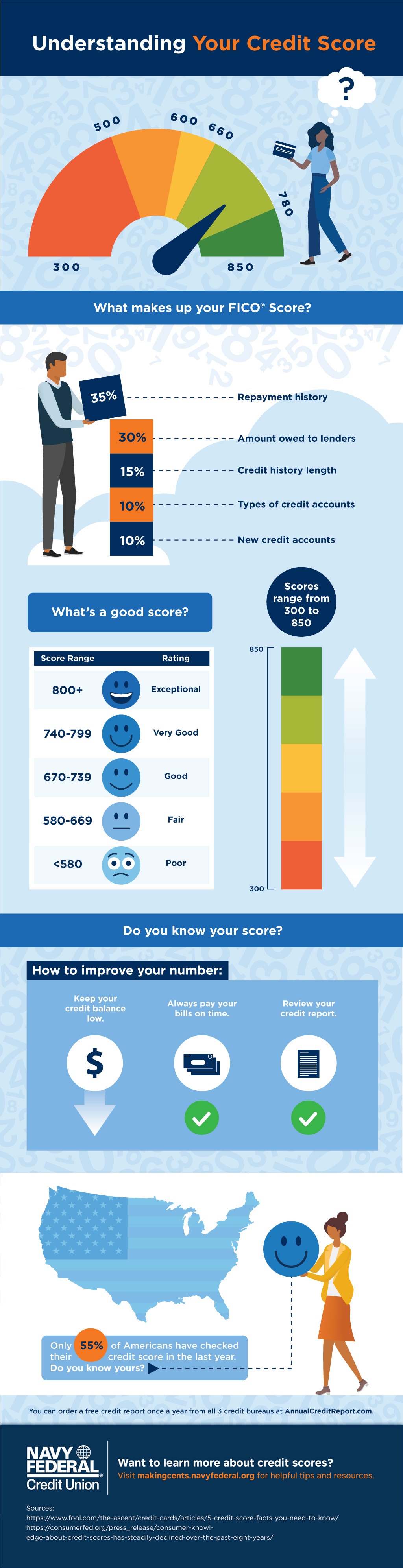

Development a strong credit reputation that fits brand new approval regarding home loan loan providers is similar to constructing an enthusiastic impenetrable stronghold. The foundation are put with reduced the means to access the offered borrowing from the bank, where saving money than simply 31% of your own overall restrict is preferred. Typical, on-date costs Bolster it economic bastion because of the demonstrating upcoming loan providers their dedication to financial precision.

With their proper borrowing use relates to keeping balance-to stop continuously discover accounts if you are showcasing adept management of present of those. This method drawings aside an effective portrait highlighting one’s aptitude to have approaching debt obligations and you may aligns harmoniously toward track starred by those people giving mortgage approvals.

Tossing Economic Documents

Loan providers scrutinize your financial background which have high outline, so it is vital to introduce a structured collection of your own fiscal records. Sorting aside income tax facts americash loans Towaoc, shell out stubs, and you can financial comments was akin to plotting a simple movement to possess mortgage officers to browse. A proper-bought presentation streamlines new pre-degree and you may pre-acceptance levels when you are featuring their commitment to dealing with financial things.

Constantly updating which databases of information is a vital ongoing activity. Per update serves for example a directing light with the an efficient loan app procedure. Getting waiting is the the answer to gliding quickly with the pre-approval in lieu of languishing throughout the initial pre-certification phase because of avoidable hold-ups.

Summary

While we moor once the voyage from the realms of pre-degree and you will pre-approval, i think about the fresh new steeped tapestry of real information we have woven. Wisdom these processes means parsing terms and you will strategizing the right path to homeownership. Pre-qualification also provides a simple glimpse in the home loan prospective, when you find yourself pre-acceptance provides a strong, reported partnership that make all the difference for the aggressive waters.

If or not you decide on the brand new quick currents away from pre-certification or the a lot more intentional trip out-of pre-approval, remember that the journey is really as very important given that interest. Brand new care and attention you eat making preparations debt narrative therefore the foresight so you can browse credit opportunities usually put the category to possess an excellent effective homebuying experience. Can get the latest winds out-of economic understanding often be at the straight back.

Faq’s

Pre-qualification is a swift comparison having fun with standard analysis and you may a credit evaluate provide an estimated research. However, pre-recognition relates to an out in-breadth application techniques that have intricate files that leads so you can a great conditional connection.

How quickly can i get pre-certified or pre-accepted?

Getting pre-degree is typically a swift procedure, will finished inside one hour. Although not, the method to own protecting pre-acceptance you’ll offer to ten working days whilst means total information and you may files.

Just what data can i importance of pre-acceptance?

To get pre-recognition, you must bring comprehensive economic pointers, together with your W-2 statements, family savings info, and you can taxation statements. This will be with the earliest money investigation and you may borrowing from the bank have a look at needed for pre-qualification.

The fresh considering data permit lenders to test debt points accurately and you may figure out the mortgage amount youre entitled to.

Are pre-certification or pre-approval top to have a primary-date homebuyer?

It’s been advised one first-day homebuyers initiate their excursion by trying to pre-certification, as this process approximates simply how much you can use and you may really does thus versus demanding a great deal of documents, therefore offering as a useful first faltering step on the quest for homeownership.

Should i rating pre-acknowledged if the I am purchasing during the a competitive business?

When you look at the an aggressive market, protecting pre-acceptance is important because it demonstrates debt reliability and you can seriousness since a purchaser, possibly giving your an edge more almost every other competitors.

A realtor can help browse competitive places by the making sure you have a beneficial pre-approval page, and this not just reveals proof financial support and support the newest agent understand your own finances and show you to help you compatible posts.