Inside Tulsa, different financial applications are available to address some other economic demands and you may homebuyer points. We have found a closer look on a few of the popular alternatives:

not, they generally require high credit ratings and larger down payments compared in order to Va finance

Such loans give several advantages, including beneficial terms and conditions, no requirement for a down-payment, with no need for private home loan insurance rates (PMI). This makes them an excellent option for those who qualify, delivering high benefit and you may accessible home financing.

Conventional LoansConventional loans are not supported by any regulators department, instead of Virtual assistant or FHA financing. They often include repaired interest rates and flexible terminology, that is designed to match certain economic issues. Antique funds are a well-known choice for individuals who meet up with the borrowing and you will down-payment standards.

FHA LoansFHA loans is insured because of the Federal Houses Management and you will are designed to assist borrowers having straight down fico scores and you can reduced off repayments. These funds are perfect for first-big date homeowners or people with smaller-than-prime credit, to make homeownership a lot more achievable. The insurance coverage provided with the fresh FHA helps mitigate lender exposure, making it possible for a great deal more obtainable mortgage terminology.

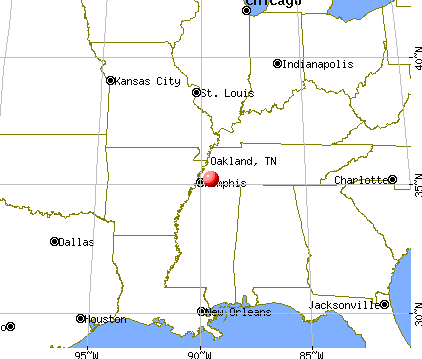

USDA LoansUSDA fund were created to have homebuyers inside the rural elements and you will provide the advantage of no downpayment. Backed by the us Agencies off Farming, these funds are a great option for those people looking to buy a home for the eligible rural and you can residential district section. The lack of a down payment demands is also notably slow down the initial will set you back of getting a house.

Refinancing are a proper financial move in the event the interest levels has actually dropped or if you need to improve your loan’s structure

Area 184 LoansSection 184 finance manufactured especially for Local American homeowners. Such finance bring advantageous conditions minimizing off payments, making them an excellent choice for people that meet the requirements. The application form will promote homeownership in this Indigenous American communities of the giving available and you may affordable funding choices.

Re-finance LoansRefinance financing allow it to be people to change the established home loan words otherwise interest rate. It is an effective way to clean out monthly obligations otherwise reduce the loan name, probably saving cash throughout the years.

Money spent LoansInvestment property fund are targeted at buying features to own rental otherwise money objectives. These types of funds are designed to service a house traders seeking acquire rental residential property and other investment functions. They often times have some other conditions and terms compared to the standard mortgage brokers, showing this new investment characteristics of the home.

Second House LoansSecond home loans are accustomed to get trips homes or most houses. These types of funds may have various other conditions than the money having number one residences, showing the initial requires and you will monetary pages off second-home buyers. They provide a chance for individuals to very own several features.

Jumbo LoansJumbo financing was intended for large-costs functions one to surpass this new conforming mortgage limitations set by authorities companies. This type of fund generally have more strict standards however, bring aggressive prices to own huge financing quantity. He’s good for buyers trying to financing more costly functions.

Down payment Guidelines ProgramsDown percentage assistance apps are created to assist first-date homebuyers having gives or reasonable-notice finance to pay for deposit. These software make an effort to generate homeownership alot more obtainable by reducing new economic hindrance of the down-payment, permitting more people to buy the basic domestic.

First-Day Home Visitors ProgramsFirst-big date homebuyer applications bring unique advantages including down interest rates otherwise advance payment direction. These software is actually customized to simply help the latest customers go into the construction field with an increase of favorable financing words, making the procedure for to buy an initial household easier plus affordable.