- Location of the property

- Down payment (when you are purchasing a property), or even the level of Security in your home (while you are refinancing).

- Your current economic picture

The original question an exclusive Lender requires is the fact Would be to things get wrong, is also that it possessions retain the well worth? If your home is inside the good shape as well as in a beneficial hot business, its experienced so much more secure, and a private Lending company is far more planning to lend facing you to property.

Instance, a single detached family within the an excellent subdivision inside Oakville, Ontario is more prominent to have a private Bank than a customized-oriented cottage inside Northern Ontario. It doesn’t mean try these out that you do not get an exclusive financial into the a bungalow, but you ount. Continuous on this analogy, in the event that one another attributes are worth $five hundred,000, a personal Financial may be willing to lend $400,000 into Oakville property, however, just $350,000 towards the cottage.

To own home buyers, advance payment ‘s the amount of their coupons you devote down when purchasing a property. Having homeowners, family security is your home worth with no present mortgage for the the home. Private lenders prefer borrowers to possess at the least 15-20% regarding advance payment otherwise house security.

- Example to own home buyers: If you’re looking to order property $five-hundred,000 in any place in Ontario, you need no less than $75,000 so you’re able to $100,000 once the advance payment. Once meeting minimal downpayment demands, the greater number of advance payment you have, the reduced the rate. Having more 20% advance payment helps you lower your personal mortgage rates rather.

- Example getting people: If you reside within the Ontario and own an excellent $800,000 home, we could provide your up to 85% of your home worthy of, we.e., home financing to $680,000. For folks who actually have a 1st home loan out-of $400,000, we can present a 2nd financial as much as $280,000 ($680,000 $eight hundred,000).

The main thing about your full financial visualize would be to possess an get-off package. Individual Mortgage loans are often short-identity approaches to help you improve money. Ergo, Individual Lenders like to see exacltly what the long online game are.

Are you searching to use the mortgage to pay off loans and increase their borrowing from the bank? Attending upgrade our home and sell they at a good speed? Otherwise will you be going to use it the real deal property financing? Its important to have a definite monetary bundle before you could cam to help you a private Lender.

Personal Loan providers would take money, credit score, and you may opportunities into account. They want to ensure your earnings is sufficient to shelter the fresh mortgage repayment. Yet not, these situations doesn’t make-or-break a deal. Most readily useful credit score or even more income can potentially help you get less home loan price.

Can there be at least credit rating for individual financial?

Zero. There isn’t any minimum credit rating to own Private Lenders for the Ontario. If you have sufficient down payment or household security, you can get acknowledged having poor credit if any borrowing from the bank.

How long can it decide to try get approved?

It may be as quickly as several hours for individuals who are able to provide all the details required. An average of it will take 1-3 days discover an affirmation.

What files ought i score a private mortgage in Ontario?

- Fill in an initial online application form

- Evidence of name, age.g. 2 items of ID’s

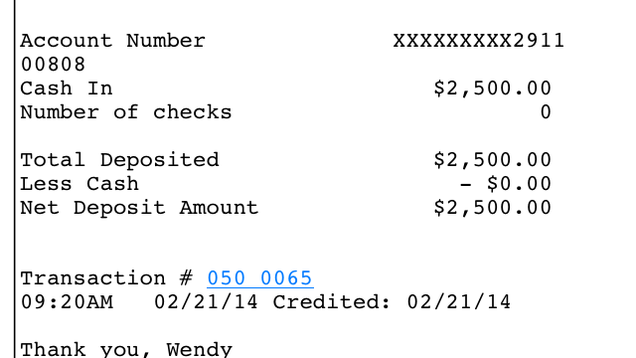

- To have house buy: Buy and you may Sale Contract, Multiple listing service Checklist, and proof of deposit

- To own house re-finance: Property Goverment tax bill, and you will established Financial Statement