Having inventory about housing marketplace lower, you may be given to get an excellent fixer top in place of good move-in-in a position domestic. You may also pick you to definitely a primary recovery opportunity on your own existing home is smart to have not located just the right fixer upper to get. Exotic Spring Bank has some possibilities and can guide you because of the process while helping you save money and time. Very first, let us view some secret items you should think about before making a decision hence strategy to use.

A beneficial fixer upper or repair opportunity into property would be since simple as cosmetics change such as for example tiling, carpet, and you may paint. But not, it may need comprehensive home improvements that take longer, currency, and you will expertise. It’s necessary to determine just what change are needed to reach your mission and decide your absolute best possibilities when you are to avoid any problems.

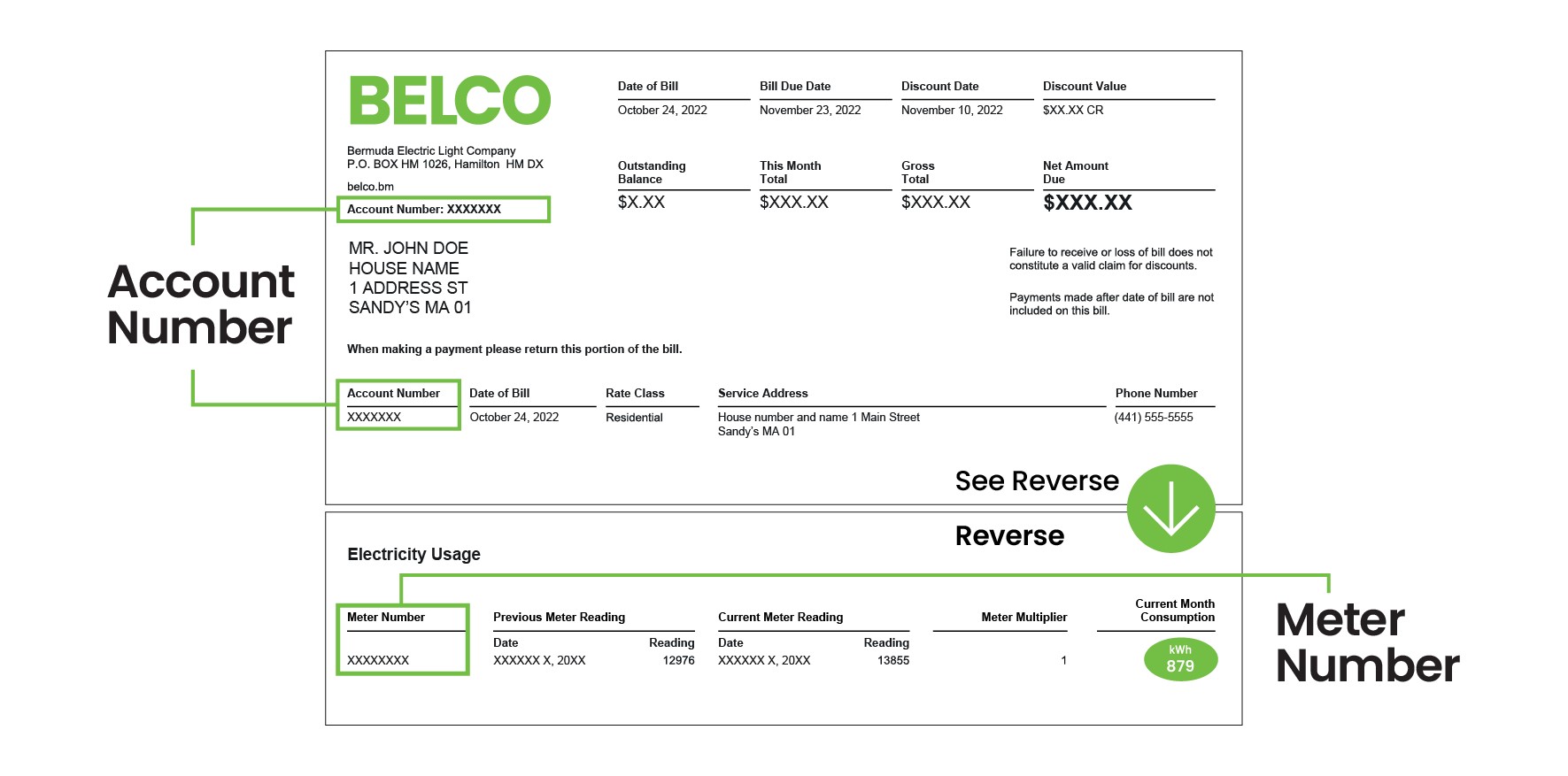

Consumers can also be thinking about a property security distinct borrowing from the bank (HELOC) which have Exotic Spring season Bank to finance an effective fixer upper

- Prices savingsOften, a good fixer upper allows you the benefit of providing a diminished speed per square foot over a change-in-ready family. Which very first savings could be used towards the restoration will set you back. Another advantage is that you could attract more family for your money. To order a beneficial fixer upper can offer alot more sqft and you can land over a shift-in-in a position home and provide you with a great enough time-label investment.

- Succeed the ownDo you need good stamped real patio dyed on liking? Always dreamed of a special cooking area that have stone counter tops? One can find benefits of personalizing your ideal house. With a beneficial fixer upper otherwise renovation so you can an existing domestic, you get the main benefit of delivering your eyesight to life.

- Smaller competitionWith collection lowest, the crowd getting successful a quote with the property increases drastically. Certain disperse-in the ready homes may have more fifteen-20 estimates, and you may your own may well not rise to the top of these list. Having a beneficial fixer higher, you have a much better threat of a lot fewer customers fighting facing you.

Customers may also want to consider a home collateral collection of borrowing (HELOC) that have Exotic Spring season Bank to invest in a great fixer higher

- Significantly more expertiseIt’s important to discover whatever you is also regarding family you might be to invest in and in case home improvements may be required past merely makeup upgrades. Were there structural issues that must be fixed otherwise major plumbing system and you will electric factors? Before generally making an offer on the people old house, be sure it’s good bones through getting a property assessment to choose in the event that you’ll find major structural problems that may need to feel had a tendency to earliest. According to the renovations, you can rarely break even if not save money profit the near future.

- Build and you will big home improvements usually takes an extended timeA fixer-higher restoration may take more hours than simple makeup adjustments. It’s important to keep in mind that big date may possibly not be completely repaired on the venture, and you will be ready for the schedule to get modified in the act. You are residing in a casing area for a couple days (or even decades) while your dream house involves existence.

- The reality is not realityDon’t go into that it investment thought one thing usually be while the quick and easy since the Do-it-yourself otherwise domestic makeover reveals create see on tv. Truth Tv isn’t necessarily truth. Repair tactics are fluid and certainly will take longer (and possibly currency) than just 1st projected. For individuals who put your own traditional correctly, you’ll not become upset otherwise astonished in the act.

Sandy Spring Lender gets the best apps so you’re loans Selma able to make the newest sily. All of our construction-to-long lasting capital system provide funding for the pick and you will design rolled to the one to simpler financing. You can protect a permanent home loan interest and also have the flexibleness necessary to renovate if you find yourself protecting time and money with one to financing verification and set-up. If structure techniques ends up, the loan goes over to the a classic home loan.

This one brings homebuyers with bucks to own a house upgrade and you may allows these to fool around with house security getting repair will cost you. That being said, if you decide this suits you, make sure to intend to live-in your house for a great very long time. Otherwise, you might find yourself ugly on the mortgage in case your real estate market fluctuates.

Everything you determine, Exotic Spring Bank provides the best equipment and you will systems to guide you through the top financial road obtainable and address any questions you’ve got in the act. More resources for investment a good fixer higher or re otherwise call us during the .

That it publication does not make up court, bookkeeping or other professional advice. Although it will probably be specific, neither brand new copywriter nor some other class takes on responsibility to have losses otherwise destroy on account of dependence on that it situation.