Show which:

- Simply click to share with you toward X (Opens inside the the brand new windows)

Listen to a short realization

The firm even offers traditional get and you will refinance finance that have choices for non-traditional individuals. Lendistry keeps an effective exposure within the Maryland, with over $100 billion deployed to help you small businesses. Lendistry Mortgage brokers will give a trend-let, customer-oriented experience for basic-big date homebuyers. President Everett Sands thinks on the strength of home ownership and you may is actually dedicated to making the financial process accessible and reasonable. Lendistry and you may LHL express clickcashadvance.com/personal-loans-id/ a goal from taking economic potential and you may economic training. LHL’s appeal is on help cost home based control to assist personal brand new wide range pit. Sands or any other Lendistry executives possess origins into the Maryland and therefore are serious about offering to the city.

Lendistry Mortgage brokers LLC offers traditional buy and you may re-finance money that have several options for low-conventional consumers, and additionally sleek FHA funds and you may Va Interest rate Protection Refinance Funds.

For years, Lendistry has received a strong and you may expanding presence about state along with $100 mil implemented in order to smaller businesses in your neighborhood. Into the discharge of the new campaign, Lendistry endeavors to aid underserved and you may undercapitalized teams availableness reasonable, versatile resource.

Subscribe to our very own newsletter

The newest announcement happens at the the best returning to prospective regional homeowners interested in residential mortgages. Based on research cited of the Lendistry authorities, home prices continue to rise along the county which have fewer and fewer homes for sale.

It’s a challenging amount of time in the brand new housing market nowadays, thus i come across no best time for you give a substitute for home buyers who require a responsible, equitable lender whom knows the teams, Sands said.

To each other, Lendistry Lenders and you will Lendistry could be a holistic capital source having underserved borrowers in the one or two most impactful routes so you can closure new riches pit: organization possession and owning a home.

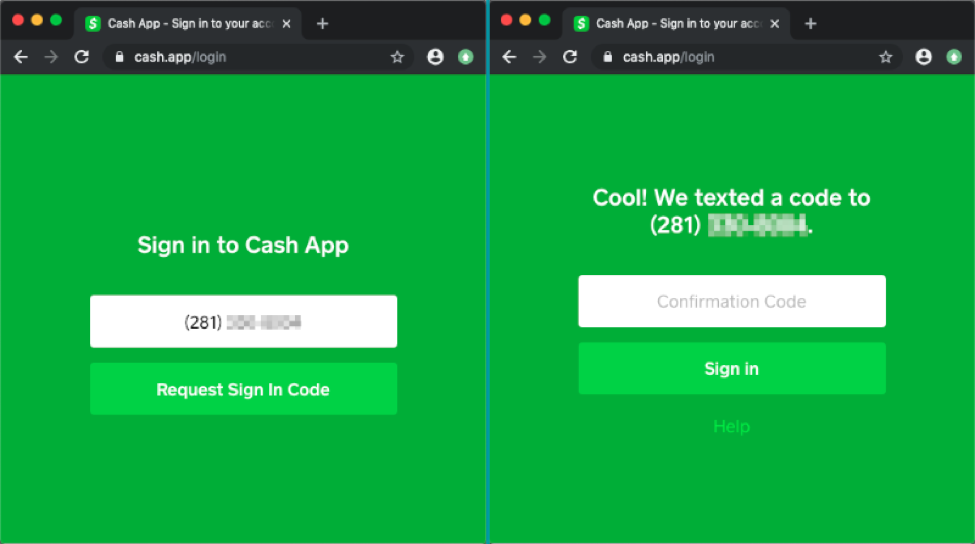

LHL, an economic tech providers, has actually a software procedure that is actually totally on line. Exactly like Lendistry, person professionals have destination to service LHL candidates who are in need of recommendations.

Lendistry Mortgage brokers gives the type of technology-allowed, customer-built experience that small enterprises has actually preferred which have Lendistry to help you first-date home buyers and you will borrowers trying re-finance or put money into assets, told you Drew Collins, controlling director off Lendistry Lenders, which provides more 30 years of experience within LoanDepot and you will Wells Fargo Mortgage.

Conscious of the power away from home ownership having expose and you will generations to come, LHL enjoys sworn its commitment to making the home loan processes available, sensible and you may approachable for all members.

Plus registered when you look at the California, Georgia, Illinois, Pennsylvania, and you can Texas, LHL pulls towards the Lendistry’s knowledge of taking significant resource so you can underserved teams. In essence, Lendistry and you may LLC share an identical core purpose off taking monetary options and you can economic education.

Sands pointed out that smaller businesses has benefitted out-of Lendistry’s approach and fact that the group originates from a similar teams as the customers. The firm intentions to offer a comparable method of potential homeowners within the Maryland.

Four away from Lendistry’s professionals has youth origins throughout the state off Maryland. We shall bear in mind what our organizations performed for people, whether it’s the studies otherwise top-notch growth. This might be a separate chance of us to surrender and you can spend they forward.

For a few years, Lendistry has experienced a workplace into the Baltimore that’s housed during the a comparable advanced once the MCB Real estate, a commercial owning a home enterprise. P. David Bramble, the newest co-founder out of MCB Real estate and you can young man out of Baltimore Times creator Contentment Bramble, try chairman of your own board off Lendistry.

You will find a-deep, strong love for my urban area and all sorts of which provides, told you Funn, a graduate regarding Baltimore Town School which was born in parts regarding Eastern and you will West Baltimore.

Its a seriously grounded bluish-collar urban area in which the individuals that alive discover difficult-performing and committed to its communities.

Funn has actually extensive records in-law due to the fact a corporate lawyer and in-family user. The guy received an excellent bachelor’s degree out-of Howard College and you can made an effective law training during the Loyola Rules College within the Los angeles.

Funn, today based in Los angeles, lauded the institution from LHL and you may emphasized its potential perception having regional homebuyers.

Just what our pledge is actually, particularly with respect to Baltimore, is that we are able to carry out the majority of an identical when it comes off impact that we are performing into the business top taking a cutting-edge, technology-let mortgage product which is also meant to personal the newest wide range gap.

The absolute most novel element of Lendistry Lenders was its deep commitment to its mission, Sands proceeded. LHL have a tendency to direct their work with issues, techniques and you may coverage to simply help help cost in home possession, he told you.

Providers ownership and homeownership are two foundational parts of starting and you will strengthening wide range. The two agencies also are crucial to a beneficial community’s financial sustainability, which Sands got into account when you are establishing LHL.

While you think about a residential area just like the an extension off the family, I see small business lending and you will mortgage lending because a couple of pillars of these community’s profits.