Federal Open-market Panel (FOMC) – Plan panel in the Government Put aside Program you to definitely set small-identity financial policy objectives on the Provided. The brand new committee is made up of the newest 7 governors of your Government Set aside Board, as well as five of the twelve presidents of the Federal Set aside Finance companies.

Fee simple Home – A keen unconditional, limitless property away from heredity one to is short for best you’ll be able to need for homes that can easily be appreciated.

First-mortgage – A home loan that’s the first mortgage filed in the public checklist and usually the key financing up against a house.

Fixed Price Mortgage – A home loan where month-to-month dominant and you can desire costs are still a similar throughout the life of the loan. Typically the most popular home loan terms and conditions is actually 29 and you may 15 years. Having a thirty-season fixed rate mortgage your own monthly installments try less than they would be into an excellent 15 year repaired rate, nevertheless the fifteen year financing allows you to pay back your loan twice as fast and you may conserve over fifty percent the total focus will set you back.

Fixtures – Private possessions otherwise advancements one to feel real-estate when loans Eclectic AL attached to the fresh new property otherwise building in a permanent manner.

In the event the bank has not guaranteed otherwise locked the eye rate, its floating and may even changes ahead of closing.

FHA Co-insured Home loan – A mortgage where this new Federal Property Management (FHA) therefore the originating lender show the possibility of loss in the latest knowledge of the borrower’s standard

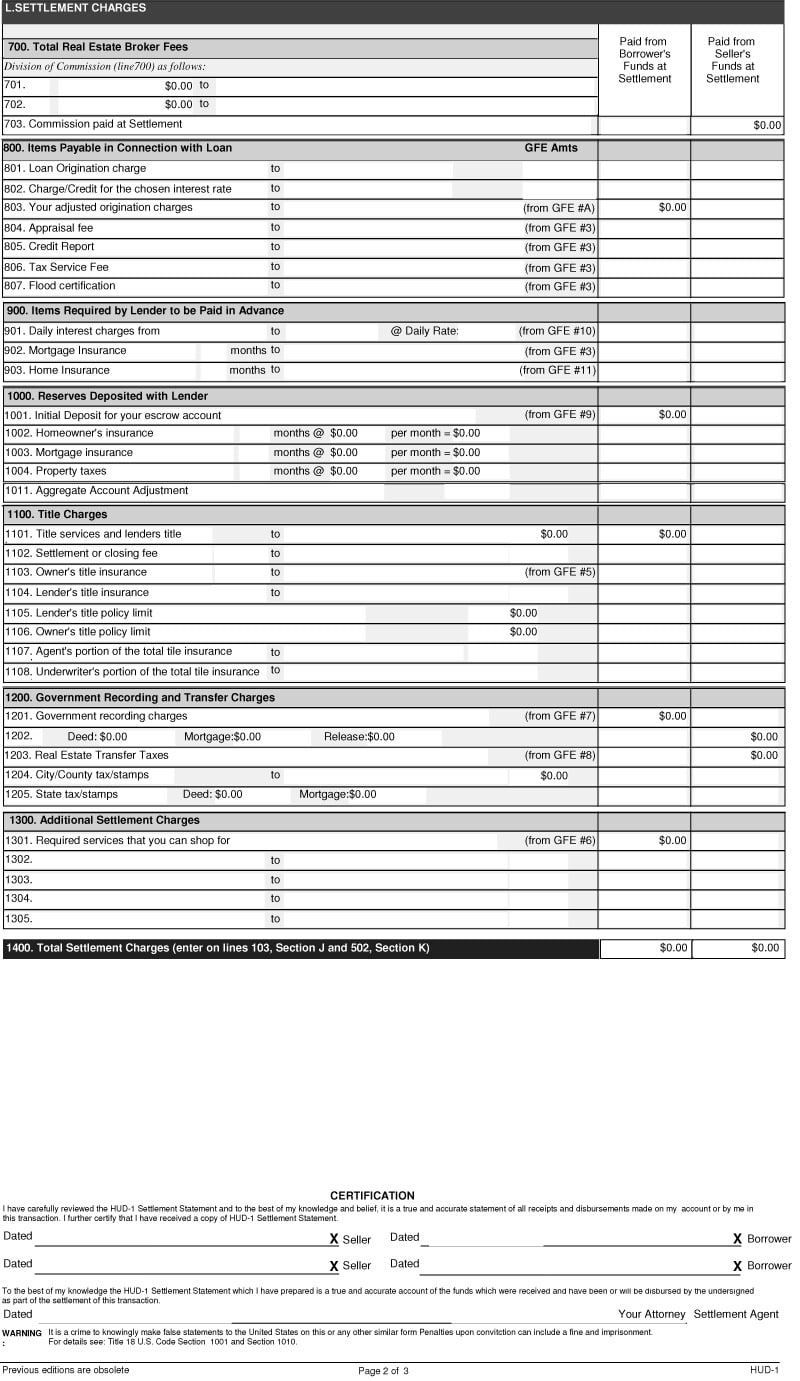

Flooding Certification – An inspection to decide in the event the a house is located in an enthusiastic area prone to flooding called a ton plain. The federal government decides if an area is during a ton plain. Lenders generally believe in the new ton certification to determine if the ton insurance rates will be required so you can receive home financing. For the testing motives, the expense of brand new flooding certification is recognized as being an effective 3rd party fee, though you will see that most lenders do not solution which payment about the debtor.

Both titled a bridge financing or move mortgage

Flood Insurance coverage – Insurance rates you to covers a resident in the cost of injuries to help you a property due to ton or high water. It is necessary for legislation that qualities based in components prone so you can flood enjoys flood insurance rates. The federal government find if or not a location is actually likely to flooding and you will considered inside the a flooding simple.

Foreclosures – The legal techniques where a great borrower’s ownership off a house is actually mixed due to default. Generally speaking, the home comes at a public auction and the continues are acclimatized to afford the financing entirely.

Freddie Mac computer – FHLMC (Government Home loan Home loan Company) One of many congressionally chartered, publicly had firms that is the biggest source of home loan finance.

Fully Amortized Case – A changeable-price home loan (ARM) that have monthly payments that are sufficient to liquidate the remainder prominent harmony along side amortization label.

Pit Loan – Short-term funding, always to cover a gap over the years ranging from a person’s purchase regarding a home hence person’s afterwards acknowledgment from finance, usually on sales of its prior house.

Regulators home loan – A mortgage that’s secured by Company regarding Pros Items (VA) or, is insured by the Federal Construction Government (FHA)pare that have traditional mortgage.

Regulators Federal Mortgage Organization (GNMA) – A national-possessed firm within the U.S. Institution from Property and Urban Advancement (HUD). Established in 1968, GNMA assumed responsibility with the special guidance financing system formerly administered by FNMAmonly titled Ginnie Mae.

Disgusting Residential Product (GDP) – Methods aggregate monetary activity available, related the business of economy. Every quarter % change (within an annualized rate) from inside the GDP reflect the organization rates out of complete monetary production. GDP gains is actually commonly accompanied because first indicator of your own electricity from financial craft. Frequency: every quarter. Source: Trade Agencies.