Kristen Barrett is a controlling editor during the LendEDU. She lives in Cincinnati, Ohio, possesses modified and you will authored personal finance posts because the 2015.

With its attributes simply for 23 claims, many possible borrowers will discover by themselves ineligible strictly predicated on geographical constraints. Stick around as our company is having the facts regarding the Point home security, ensuring you will be well-prepared to make the step two on your economic trip.

- Why does Area functions?

- Qualifications

- Fees

- Pros and cons

- FAQ

Regarding Section

Built from inside the 2015, Area will build homeownership a great deal more available and you may financially versatile. The mission would be to bring home owners a cutting-edge answer to tap in their house collateral versus month-to-month repayments. Through providing domestic equity opportunities (HEIs) rather than antique loans, Section will bring another resource service.

The company purpose people seeking to economic independence instead trying out a lot more financial obligation. Whether or not you need to combine highest-notice costs, upgrade your residence, otherwise cover instructional costs, Point has the benefit of a zero-monthly-fee services one aligns along with your house’s coming worthy of.

Why does Area functions?

Section even offers good nontraditional solution to availability your own house’s value as a consequence of the home security financing model. Instead of traditional family security loans or family equity credit lines, Part acts as an investor on your own property, so there are not any monthly payments.

- Mortgage numbers: $25,000 $five-hundred,000

- Identity size: 3 decades, zero monthly premiums

- Installment alternatives: Pay early rather than charges

- Novel features: Zero monthly payments, no influence on debt-to-income ratio, no earnings conditions

Having Point’s flexible terminology, it is possible to make sure your investment suits your financial means, regardless if you are seeking generate tall home improvements or consolidate loans. A 30-12 months term no monthly money provides you with monetary liberty.

Area recoups their financing after you promote your house or at the the end of the word. If for example the finances changes, you might pay Point early in place of punishment.

Who has entitled to a point household equity capital?

Whether or not you own a single-home, a condo, an excellent townhome, or property which have as much as four equipment, Section you are going to suit your needs. Money services and you can 2nd belongings can also meet the requirements. Even faith-kept qualities obtain the eco-friendly white sometimes.

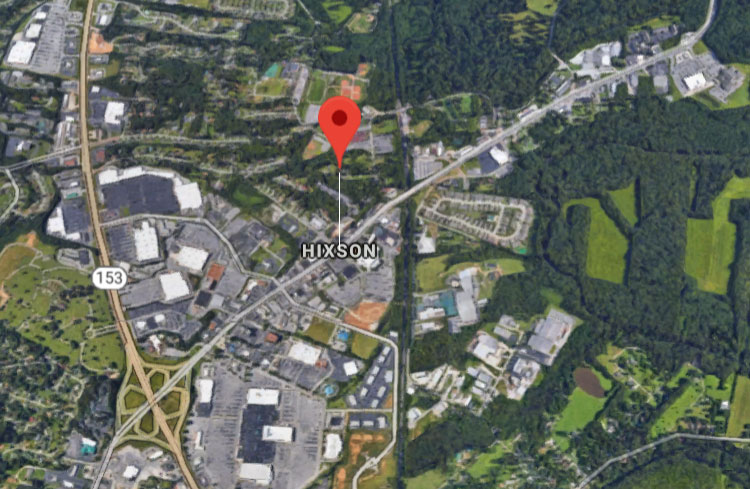

Eligible states: Arizona, California, Tx, Florida, Their state, Illinois, Indiana, Massachusetts, Maryland, Michigan, Minnesota, Missouri, Nj, New york, Kansas, Oregon, Pennsylvania, South carolina, Tennessee, Utah, Virginia, Arizona, and you will D.C.

How do you pay-off a property security financing out-of Section?

Having Point’s domestic security money, you’re not thinking about monthly installments otherwise instant cost financial obligation. You may have 3 decades to pay off the capital, which you yourself can carry out after you offer your residence otherwise on anytime till the stop of one’s name. For people who promote your home inside people 30 years, Area states a share of your proceeds equal to their financial support.

Area has the benefit of a resident cover cap-a period-founded limitation matter one serves as a barrier just in case you find its house’s well worth increase. That it cover mode you could potentially keep more substantial finances whenever offering your house.

In case the 31-12 months name finishes while haven’t ended up selling, you can easily pick Suggest predicated on their house’s economy really worth. Different ways, particularly property security loan or reverse home loan installment loans online Oregon, normally money this buyout.

Given that Point invests of your home, your own buyback costs depend on the residence’s change in worth whenever you decide to leave. You handle if you want to sell, refinance, otherwise get back the collateral within the 31-12 months name.

Usually do not error Point’s zero-monthly-commission design to have a charge-free experience. You may not make instantaneous away-of-wallet costs, however, charges occur. For example, Part fees a control percentage as high as 3.9% ($step one,000 minimum) also 3rd-group fees instance appraisal, escrow, and you may government costs.