Navigating credit can often seem overwhelming. The situation becomes even more exasperating for those who find themselves trapped in the quagmire of low credit scores.

With a low CIBIL score, financial opportunities often become out of reach, causing frustrations and limiting aspirations. This guide serves as your companion in the journey towards improving your CIBIL score and achieving financial success.

Understanding Your CIBIL Score

Your CIBIL score is a numerical representation of your creditworthiness and plays a pivotal role in your financial life. It is calculated based on multiple factors, including your repayment history, credit utilisation rate, and the length of your credit history.

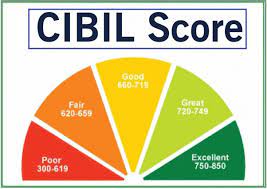

An understanding of credit score ranges is crucial as they can have profound implications:

- Low range (300-549): This score may result in the rejection of the loan applications. Even if approved, it may carry high-interest rates.

- Middle range (550-749): Borrowers within this range are likely to be approved for loans but might not get the best interest rates.

- High range (750-900): Borrowers with these scores are usually offered loans on the most favourable terms.

Why Is Improving Your CIBIL Score Important?

A high CIBIL score is synonymous with financial success. It enhances your ability to secure credit and gives you leverage to negotiate better loan terms.

For example, you are trying to buy a house in your city. With a high CIBIL score, you could secure a home loan and negotiate a lower interest rate, saving lakhs of rupees over the loan tenure.

Strategies for Improving Your CIBIL Score

You might be pondering over the question of “how to increase my CIBIL score?”

Here are some effective strategies that can help:

- Timely bill payments: Ensure you pay all your bills, especially EMIs and credit card dues, on time. This behaviour is a positive indicator of your creditworthiness.

- Effective credit utilisation: Keep your credit utilisation ratio below 30% of your total credit limit.

- Maintaining a healthy credit mix: A balance between secured (home loan, auto loan) and unsecured (credit card, personal loan) credit can reflect well on your CIBIL score.

- Length of credit history: The longer your credit history, the better it is for your score. Closing old credit cards, especially those with a good repayment history, may not always be the best strategy.

- Limit hard enquiries: Each time you apply for credit, lenders perform a hard enquiry, which can temporarily lower your score. Instead, use online eligibility checkers before applying to reduce hard enquiries.

Tactics for CIBIL Report Correction

One of the strategies for “how to increase my CIBIL score” involves the regular monitoring and correction of your CIBIL report. Sometimes, your report might contain inaccuracies that can adversely impact your score. It could be anything from incorrect loan foreclosure data to erroneous personal information.

Identifying these inaccuracies and disputing them promptly can help in improving your score.

- Identifying inaccuracies: Regularly review your CIBIL report for any inconsistencies, like an incorrectly reported loan foreclosure, and dispute them immediately.

- Dispute resolution: File a CIBIL dispute if you notice inaccuracies. You can do this online by providing relevant documents to support your dispute.

Utilising Personalised Credit Score Monitoring

Personalised credit score monitoring platforms can be a lifesaver in your quest to improve your CIBIL score. These platforms provide regular updates on your score and offer personalised insights on how to improve it. They give you the tools to stay on top of your credit management, making it easier for you to understand and manage your credit effectively.

Overcoming Obstacles in CIBIL Score Improvement

In your journey to improving your CIBIL score, you might encounter obstacles, such as high credit utilisation or a high number of hard enquiries.

To overcome these:

- High credit utilisation: If you’re consistently using more than 30% of your credit limit, consider requesting an increased limit or utilising another credit card to balance out the usage.

- High number of hard enquiries: Plan your credit applications carefully. Use online eligibility checkers before applying for any credit to avoid unnecessary hard enquiries.

Conclusion: Taking Charge of Your Financial Success

Improving your CIBIL score cannot happen overnight. You need to put in consistent effort and a sound understanding of credit management.

If you were struggling to know “how to improve my CIBIL score”, With these strategies, you can take the driver’s seat in your journey towards financial success. You can move towards fulfilling life aspirations and upgrading your lifestyle. After all, your financial success is in your hands.