Disclosure report

Stuart Snaith can not work getting, demand, individual offers inside otherwise found financing away from any company or organisation who does take advantage of this informative article, and has shared zero related affiliations beyond the informative meeting.

Couples

In the a bid to deal with Canada’s construction crisis, Deputy Finest Minister and you may Loans Minister Chrystia Freeland revealed the latest change in order to financial guidelines on the Sept. sixteen, set to take effect during the December, geared towards making housing less expensive.

The first significant alter is actually a rise in the cost cover for insured mortgage loans, raising it to help you $step one.5 million of $1 million.

In Canada, if the potential home purchasers reduce than simply an excellent 20 per cent deposit, they are necessary to possess standard insurance rates. Financial insurance protects lenders against default helping people buy home having as low as four per cent downpayment. Before statement, insurance coverage only has become available for homes coming in at $1 million otherwise reduced.

The following alter ‘s the https://paydayloancolorado.net/brook-forest/ expansion away from amortization periods. Up to this year, consumers who expected default insurance policies to their mortgage loans have been limited by a twenty-five-seasons amortization several months.

During the August, it was casual so that first-date people to find recently based belongings with a thirty-12 months amortization. It has now become expanded to allow basic-big date buyers purchasing any household. As well, anybody trying to get a separate create can now make the most of a thirty-seasons financial.

Freeland told journalists the changes often put the dream of owning a home when you look at the grab a whole lot more more youthful Canadians. But how almost certainly are such changes and also make home ownership even more doable to own Canadians which even more notice it since a distant dream?

Drawbacks to keep in mind

For each element of it announcement will increase buyers’ capacity to pick a house. Alot more customers should be able to availability 31-12 months mortgages, which goes hands-in-give with down mortgage payments. Simultaneously, a lot of Canadian property stock is within the rates cover getting insured mortgage loans.

But not, even with these transform, value stays problematic. In the case of the elevated rate cover, Canadians still need to have the ability to spend the money for mortgage when you look at the the initial put. Once the couples Canadians can afford home financing more than a great billion bucks, the brand new feeling of your own 31-year mortgages are the greater extreme of the a couple strategies.

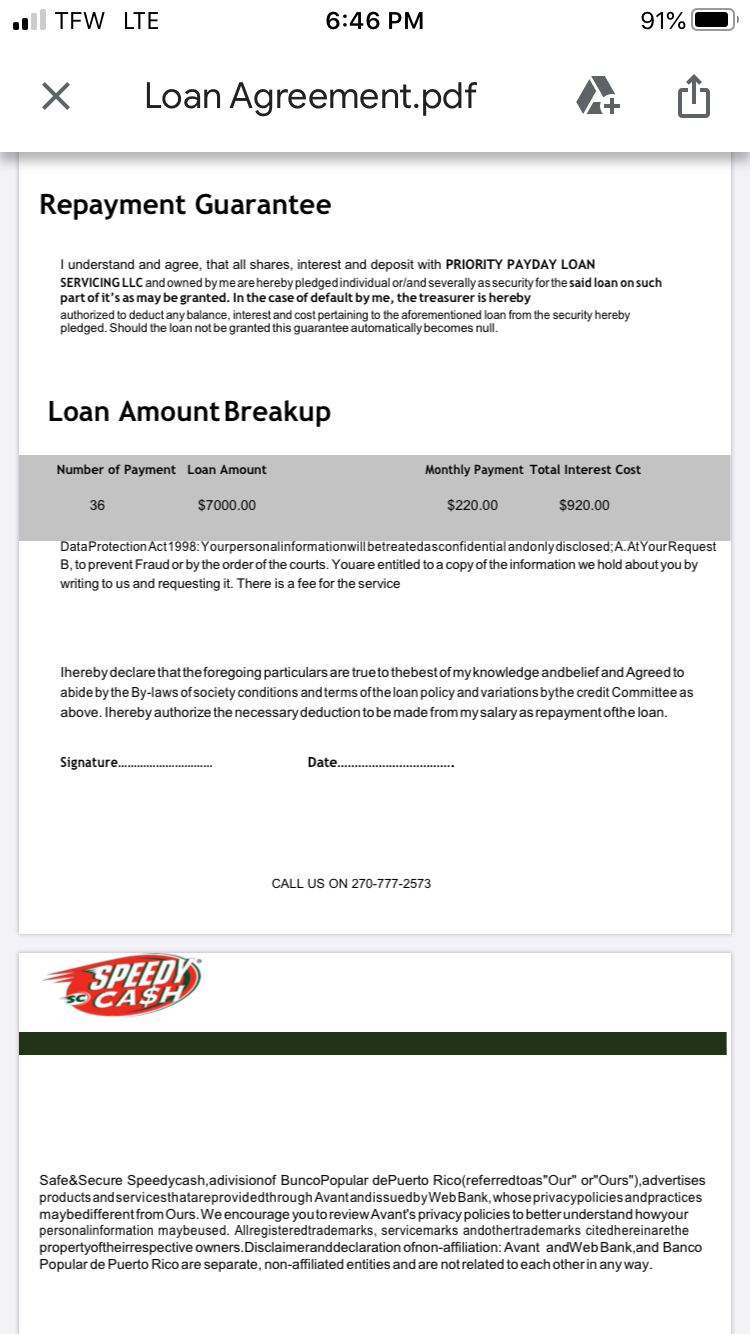

Regarding 31-seasons mortgages, while payments is smaller, way more desire will be repaid along side lifetime of the mortgage. Believe that loan away from $700,000. That have a twenty five-year home loan in the four percent, the month-to-month mortgage rates might possibly be $4,071 (overlooking the expense of standard insurance rates). That have a thirty-season mortgage for a passing fancy base, it falls in order to $step 3,736. Yet not, in addition, it includes a rough 24 percent boost in focus paid along side lifetime of the mortgage.

Another significant factor to keep in mind is that Canada already has got the higher family financial obligation to help you throwaway money regarding the G7. In which does much of that it personal debt come from? Mortgage loans.

A beneficial 2023 declaration regarding the Canada Financial and you may Property Organization discover that 75 percent from Canada’s domestic financial obligation originates from mortgages. This type of large degrees of loans can also be create significant ruin while in the moments away from economic crisis.

Obviously, large mortgages setting more financial obligation. Due to the fact this new mortgage statutes are made to promote buyers a whole lot more independency, the fresh new much time-term effect away from big money to your home financial obligation therefore the wide savings remains to be viewed.

4 mil home by the 2031

If you are this type of the fresh new changes is trigger consult, specifically for the brand new-stimulates, Freeland believes this new consult these types of strategies build often incentivize a lot more this new housing structure and tackle brand new housing lack. Such transform are part of brand new government’s work to fulfill their purpose of creating nearly five million the fresh property from the 2031.

This new government’s capability to be sure this type of new land are manufactured usually become key to ensuring such the fresh mortgage laws and regulations submit on the pledge of making property inexpensive.

Regarding the absence of enhanced also provide, the danger is such alter you could end up highest pricing, especially due to the fact Lender away from Canada continues to cut interest rates and with all this week Canada’s rising prices speed in the end hit the Bank regarding Canada’s address. Indeed a current declaration by the Desjardins cautions you to increasing the length of mortgages you certainly will become worse affordability.

Along the 2nd couple residence, the fresh interplay ranging from price falls, brand new home loan rules and other federal initiatives to handle property also provide will have to be spotted closely. And also make things a great deal more fascinating, the potential for an early on election can lead to an option approach to property cost offered present polling recommending Pierre Poilievre’s Old-fashioned Cluster could more than likely means another majority government.