You can spend high rates otherwise origination fees in the event that lenders see you because an effective riskier borrower without a job. Holger Scheibe/Getty Photographs

- Introduction

- Skills financing qualification

- Types of finance to adopt

- Even more money

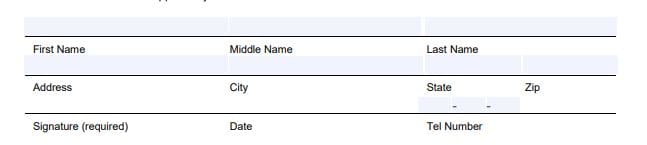

- Navigating the application processes

User hyperlinks to the facts in this article come from people you to definitely make up you (discover our very own marketer disclosure with your set of partners for more details). not, the feedback is actually our very own. Observe we rates personal loans to write unbiased evaluations.

- Some loan providers produce a loan with no employment, though you’ll likely require some style of money.

- See your loan’s interest rate, label size, and charge in advance of accepting the terminology.

- In place of taking out fully that loan, you might inquire friends to own let otherwise drop towards the the discounts.

How lenders glance at applications

Loan providers check of numerous factors in terms of your application, in addition to credit rating, payment records, debt-to-money proportion, as well as your annual money. Although this may seem disconcerting when you’re jobless, of many lenders are prepared to envision other sources of money. This might include alimony, impairment payments, retirement benefits, and a lot more.

You may want to be able to find an option source of earnings away from a side concert, rating an excellent cosigner, otherwise give equity to boost your chances of delivering accepted.

You may have to spend highest interest levels otherwise origination charges because the lenders view you since the good riskier debtor without a job.

“If you don’t have a career, taking out a loan is something that you ought to prevent because much as it is possible to by the likelihood of skipped otherwise later repayments and you may a top interest,” claims Forrest McCall, private fund expert and originator out-of PassiveIncomeFreak. “If you take out a loan, make sure you completely understand the fresh new regards to the loan, so you can pay it back without accumulating extreme appeal costs.”

Secured finance

You may be a good capable of getting financing instead verifying your income for many who hope security such as for example an automobile otherwise almost every other assets that lender can take if not pay-off the debt. It is labeled as a guaranteed loan.

What to expect

Whenever choosing whether or not to take out a loan or not, Andrew Latham, an authorized Monetary Planner while the managing editor of SuperMoney, claims you really need to mostly think about the function of the borrowed funds and you may whether you will have money to repay it. It’s quicker important should you choose or do not have a good job.

“Providing a loan without a job are an intelligent circulate whenever you are investing their knowledge otherwise carrying out a corporate,” Latham states. “It’s possible to-be economically in control and also a good consumer loan without a job if you has actually an enthusiastic solution source of income, like appeal and you will returns, social protection, long-title impairment, alimony, otherwise a pension.”

When you are making an application for financing with no employment, loan providers could possibly get envision various supplies once the alternative earnings, instance rental income, alimony, child service, retirement benefits, otherwise capital production.

Certain lenders may imagine unemployment positives due to the fact temporary income, however, this commonly utilizes the fresh new lender’s principles plus the balance of your own almost every other monetary Oakland installment loans bad credit situations.

An effective credit score is extremely very important once you run out of conventional a career and therefore are making an application for that loan. It reassures loan providers of creditworthiness and you may power to pay back the latest financing.

Secured loans was money that want security, instance a car otherwise domestic. That it decreases the lender’s risk and can even help you obtain financing instead conventional employment.

Yes, an excellent co-signer having steady income and you will a good credit score can be replace your mortgage application’s strength by providing even more guarantee towards the financial.